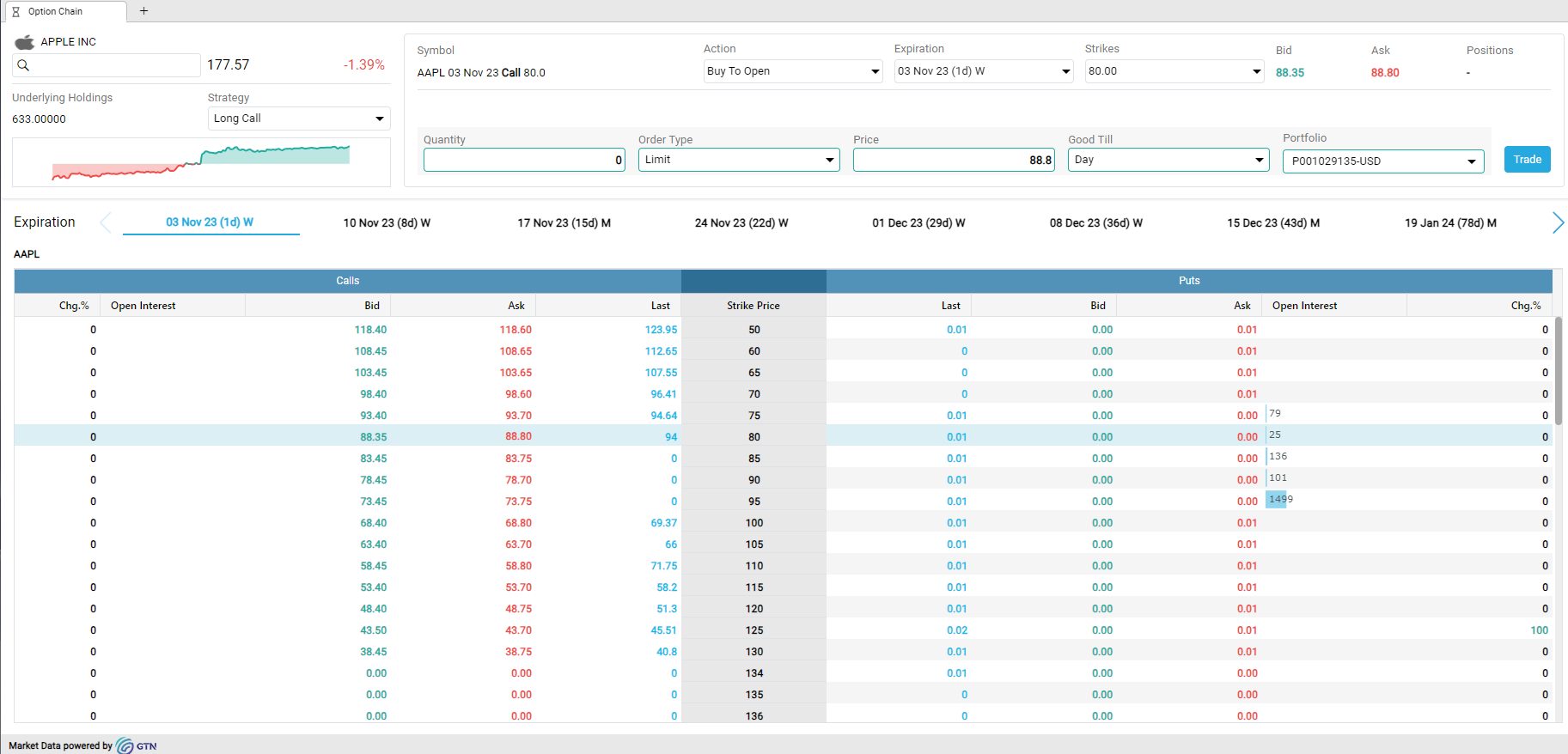

Option Chain

- Click on the

icon in the workspace. Select the Trading tab from the side menu, then click on Option Chain.

icon in the workspace. Select the Trading tab from the side menu, then click on Option Chain.

- This feature displays the call and put options for the selected symbol.

- An Options contract is a type of derivative financial security as it derives its value from other securities like stocks. The options contract provides the trader with the option to buy/sell the asset at a specific price.

- A Call option is a contract that offers the buyer the option to buy the asset (i.e. a stock) at a specific price and within a stipulated time window.

- A Put option is a contract that offers the owner of an asset to sell it at a specific price and within a stipulated time window.

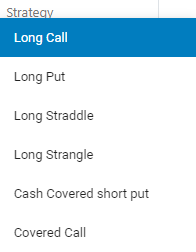

- Select the strategy you prefer, using the Strategy drop down. Options trading provides a number of different strategies.

- Long Call : A simple bullish strategy that offer a significant growth potential and investors realize gains when the market price rises above the strike price. You can simply buy and sell a call before it expires to profit off the price range.

- Long Put : A simple bearish strategy that can yield big rewards. You would purchase a put option if you believe that the stock is going to fall, since the value of a put goes up if the underlying stock price goes down. However, this option also has the risk of expiring completely worthless upon the expiration date.

- Long Straddle : A long straddle consists of one long call and one long put. Both options have the same underlying stock, the same strike price and the same expiration date. A long straddle is established for a net debit (or net cost) and profits if the underlying stock rises above the upper break-even point or falls below the lower break-even point.

- Long Strangle : A strangle is similar to a straddle, except that the put and call are at different strikes. These out-of-the-money options make a strangle cheaper than a straddle, but require a bigger move to make a profit.

- Cash Covered short put : An options strategy where a seller enters a short put position for which he receives cash. In exchange for that cash however, the seller is obligated to buy the underlying stock should the buyer of the put option (long position) wish to exercise it.

- Covered Call : An options strategy that involves holding a long position in the underlying asset and selling a call option on the underlying asset. This strategy is usually employed by investors who believe that the underlying asset will experience only minor price fluctuations.