Investment Store

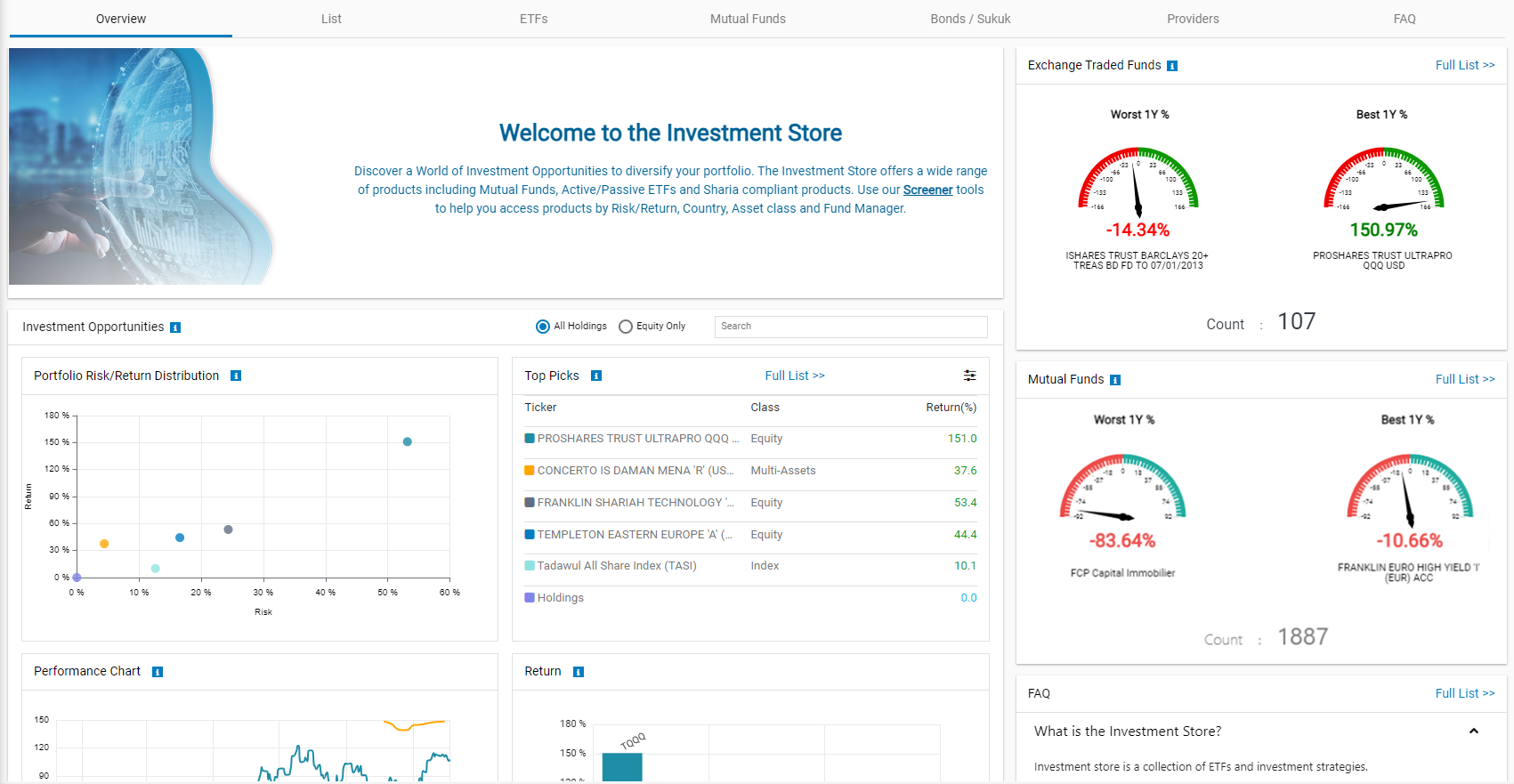

While the rest of the app mainly deals with equity trading (i.e. stocks), the investment store provides other investment options that will help diversify your portfolio (i.e. avoiding the "all eggs in one basket" scenario). The Investment Store serves as a marketplace for a wide variety of securities including Mutual Funds, Exchange-Traded Funds (ETFs), Bonds/Sukuk, and Sharia-compliant securities.

- Upon visiting the Investment Store, you are greeted with a comprehensive graphical dashboard of investment opportunities, and a variety of performance ratios for the different securities available.

- Exchange-traded funds are 'packaged investments', meaning, they contain multiple securities (including stocks) that are sold and managed through an asset managing firm (or 'Provider').

- The application offers ETFs and mutual funds by some well-known financial asset management firms, such as Goldman Sachs Inc, Blackrock, HSBC Global, Allianz, Fidelity Investments, and many more.

- ETFs can be traded via the app similar to trading stocks, however, they need to be managed by the asset manager as these products are often part of an overall investment strategy designed to match an individual with a particular risk appetite/ tolerance level.

- Thus, taking into account the individual's behavioral patterns and their desired rate and period of return, the asset manager develops an ETF with symbols and other securities that are weighted to match the customer's acceptable risk level.

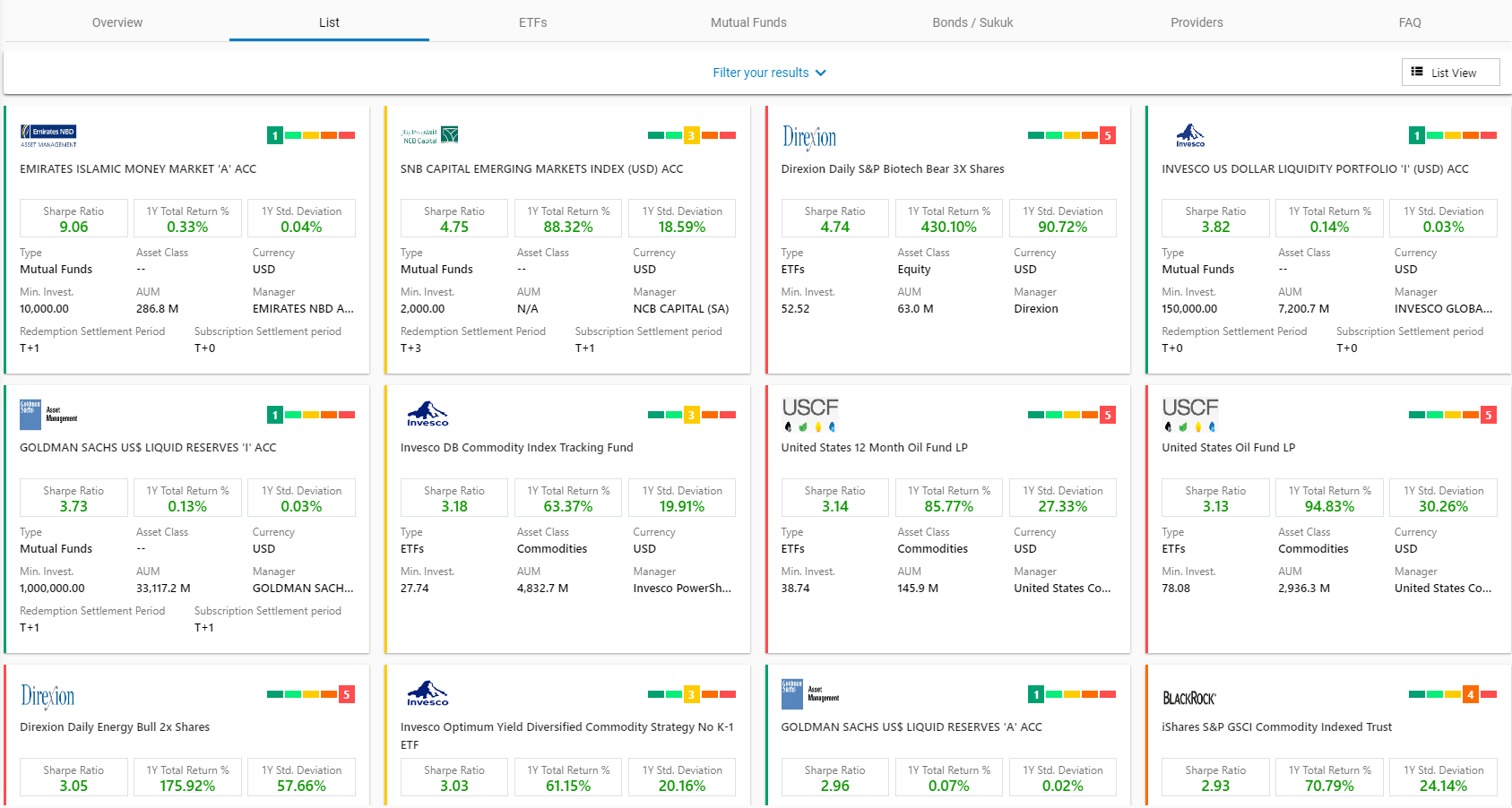

Screening ETFs, Strategies, Mutual Funds and Bonds/ Sukuk securities

- Navigate to the List, ETFs, Mutual Funds, or Bonds/ Sukuk tabs in the investment store, then click on Filter your Results.

- You may now select your preferred risk/ return level, specify additional criteria and press the

button in order to filter a set of matching ETFs or mutual funds that match your investment requirements.

button in order to filter a set of matching ETFs or mutual funds that match your investment requirements.

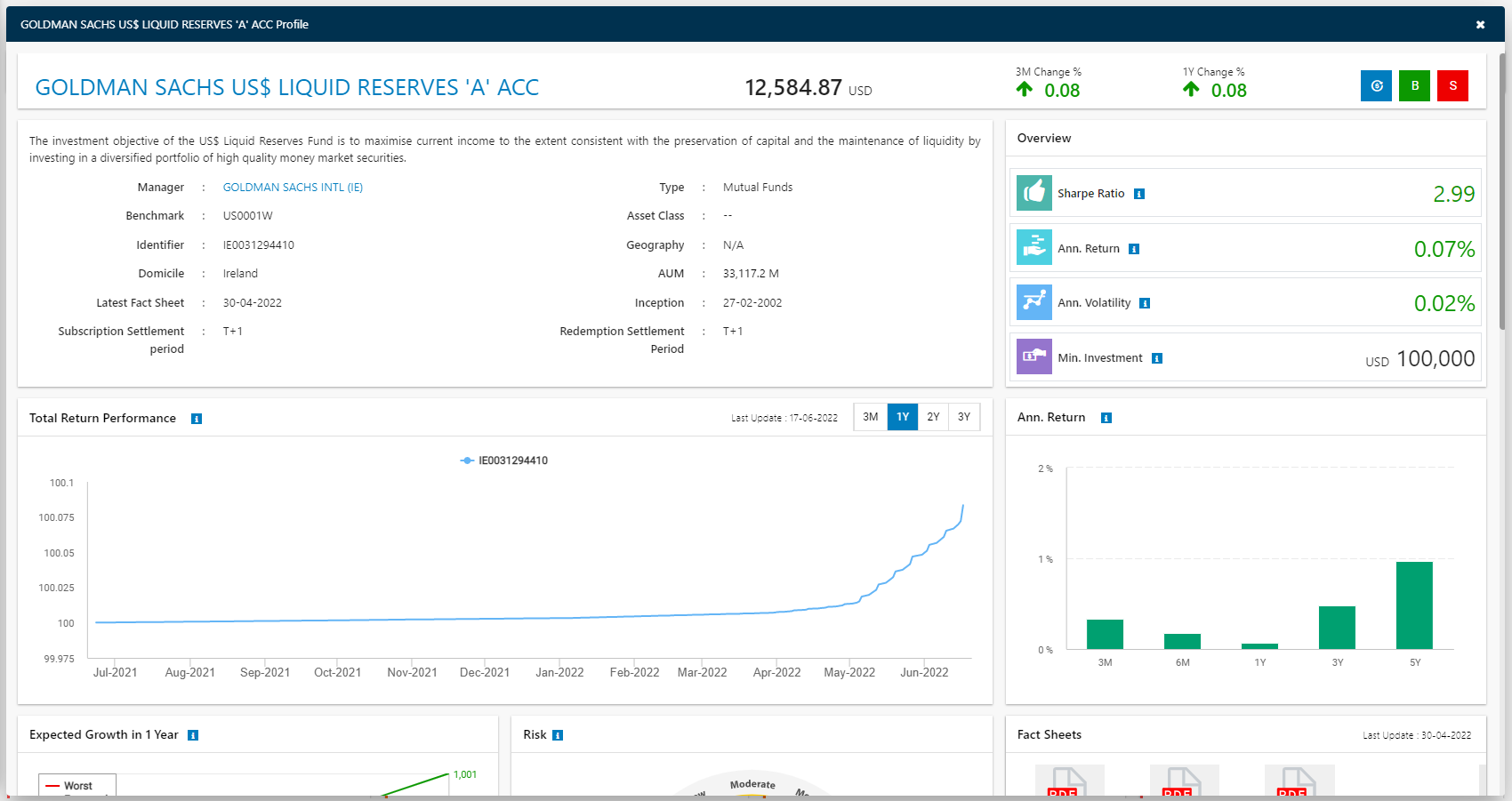

- Upon clicking on an ETF, mutual fund, or fixed income security, a detailed window opens, you may then press the

button to purchase the security, similar to purchasing stocks in the application.

button to purchase the security, similar to purchasing stocks in the application. - Similarly, if you already own an ETF, you may sell this security by clicking on the

button of the corresponding ETF window.

button of the corresponding ETF window.

- Investment Type: You may select from the three main investment types.

- Investment Strategies

- ETFs

- Mutual Funds

- Asset Class: This refers to the composition of the ETF, strategy, or mutual fund. i.e. the financial securities with which it is composed of, this can be equity (like stocks), or with currency (FX), commodities, or other types of financial securities (these will be known as the constituent securities of the investment plan).

- Currency: This refers to the currency of the ETF (i.e. USD, AED, EUR, or GBP).

- Manager: This refers to the asset manager or provider of the ETF. If you wish to search for ETFs from a particular provider, you could do so by filtering the list based on the asset managing firm.

- Return: You may filter the list of ETFs based on the likely return percentage that you would receive in one year.

- Sharpe Ratio: This refers to a risk-adjusted rate of return for financial securities.

- Upon clicking on an ETF, mutual fund a detailed window opens, you may then press the

button to purchase the security, similar to purchasing stocks in the application.

button to purchase the security, similar to purchasing stocks in the application. - Similarly, if you already own an ETF, you may sell this security by clicking on the

button of the corresponding ETF window.

button of the corresponding ETF window.

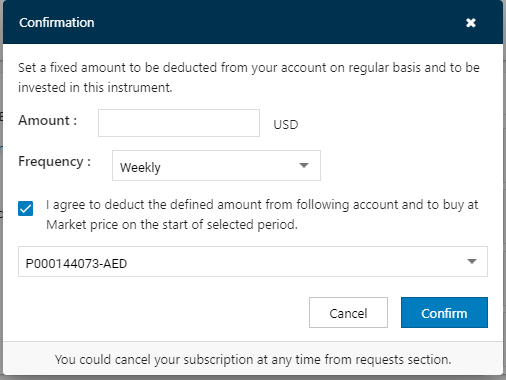

Recurring Payments

- By making a recurring payment, you can set a fixed amount to be deducted from your account on regular basis to be invested in a store ticker card you prefer.

- To make a recurring payment, click on the

button on an ETF, Mutual Fund or a Bond/Sukuk.

button on an ETF, Mutual Fund or a Bond/Sukuk.

- To make the recurring payments, select the store ticker card you wish to invest in, and click on the

button.

button. - Enter the amount you wish to be invested and select the frequency of the recurring payment from the drop down.

- Click on the

button to confirm the payment.

button to confirm the payment.

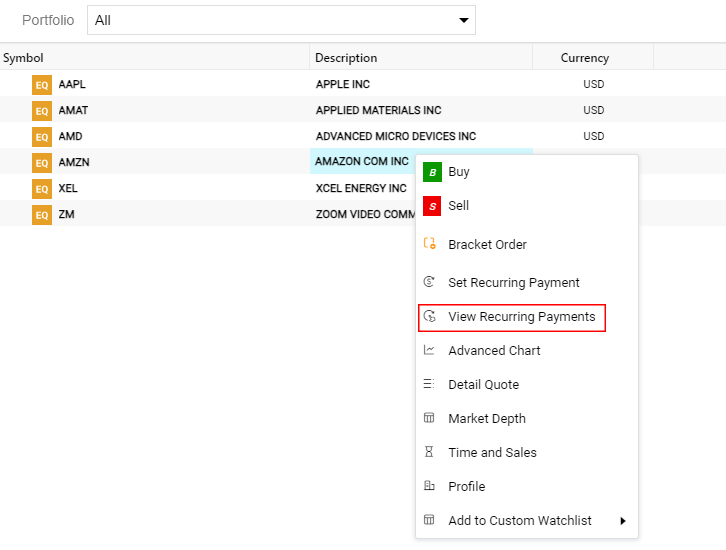

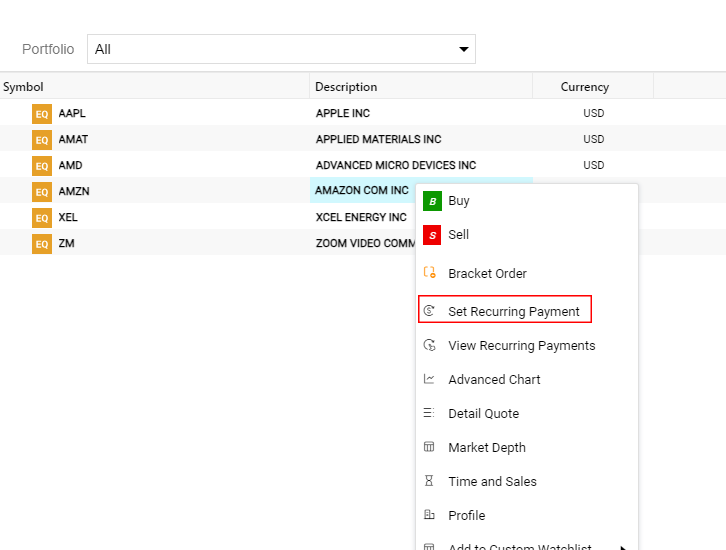

Note: Recurring payments for equities can be initiated through the right-click options available on the symbols in the portfolio.

- You can view the recurring payments you make under the Recurring Payments tab in Requests.

Note: You can also view Recurring payments by right-clicking on a symbol (in the Portfolio or watchlist) that has recurring subscriptions assigned to it, and selecting 'View Recurring Payments'.