Placing Margin Orders

Margin Trading is the practice of utilizing borrowed funds to purchase above the user's current buying power, while maintaining a buffer deposit of assets [Cash and/ or Equity] to cover up for the fluctuations of value [Volatility] on the positions acquired by utilizing such provided margins.

Note: In order to trade on margin, your account and portfolios should be 'margin enabled' by a System Administrator. Please feel free to contact customer support to enable this feature for you.

There are two types of margin orders that can be placed within the application.

1. A ‘Day’ margin order is valid until the end of a trading day.

2. An ‘Overnight’ margin order is valid until it meets a match on any day.

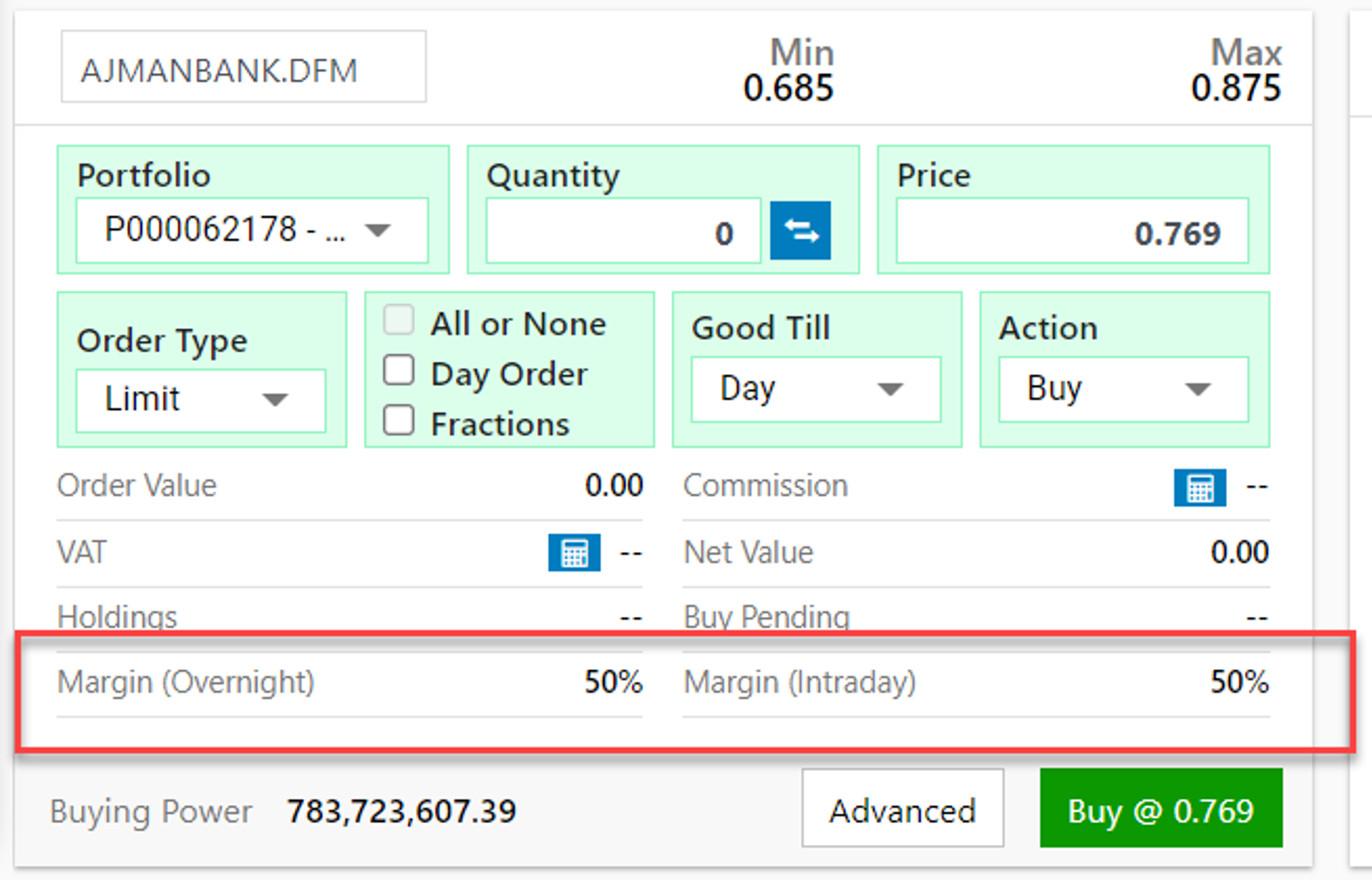

- The margin overnight and margin intraday percentages will be displayed at the bottom of the order ticket's summary information. These percentages represent how much you may exceed your existing cash balance (i.e. 'buying power') within the portfolio.

The actual steps of placing a margin order aren't different from that of a normal order, except that you would be able to place an order value that is higher than your portfolio's 'buying power'.

- Right-click on a symbol on a watchlist and select buy or sell. An order ticket will then open.

- Start by filling in the mandatory fields in the order ticket including the quantity and price fields.

- Press the relevant action button (Buy or Sell) to proceed. The system will then ask for your transaction password, enter it and press 'OK' to confirm your order.

Note: To customize settings relating to margin trading or trading in general, please refer to the section on Trade Settings.