Order Ticket

The order ticket serves as the core component through which you can buy / sell stocks using the application. The mandatory and optional fields of the order ticket should be filled in a way that best reflects your trading preferences. This section aims to provide a walkthrough of the basic and advanced components of the order ticket.

Please note, the default settings relating to many fields of the order ticket can be customized according to user preference from Trade Settings.

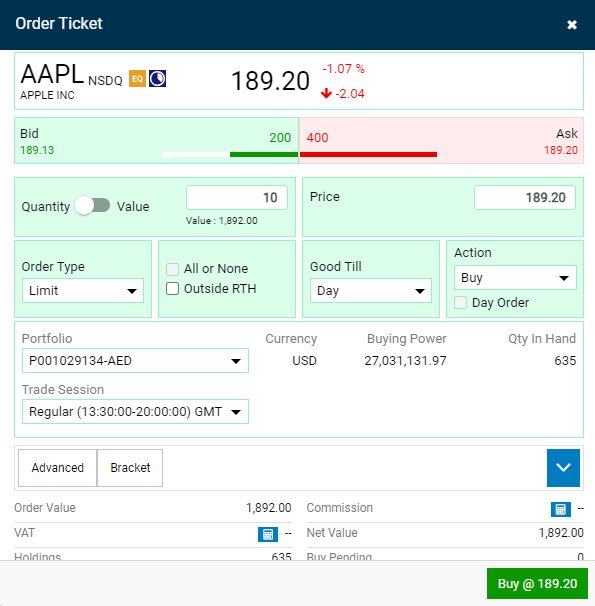

Order Ticket for a 'Buy' order *

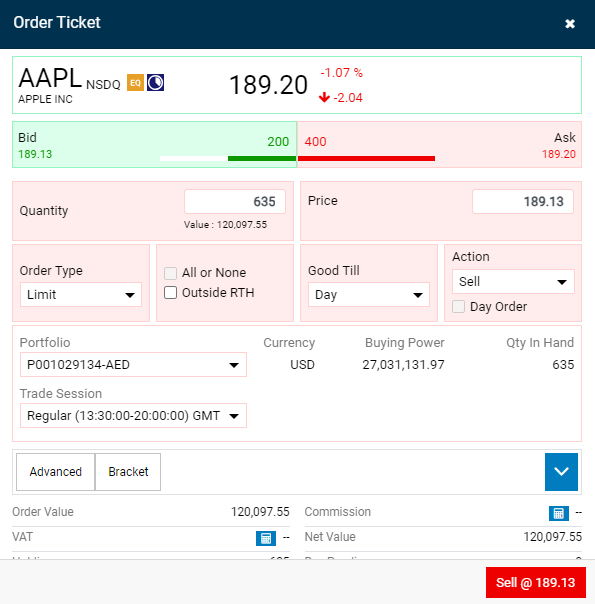

Order Ticket for a 'Sell' order *

* Please note: The 'Book Keeper', Sell T+0, and, Sell T+1, fields are only applicable to the Egypt version of the application.

Components

- Quantity – Refers to the total number of shares of a particular symbol a user wishes to buy or sell (i.e. 'purchasing 20 TSLA stocks').

- Value – Refers to the total monetary or currency value of the buy or sell order (I.e. 'purchasing 2000 USD worth of TSLA stocks'). It is calculated as: stock price * quantity of shares.

- Note: Use the

toggle to switch between quantity and value entering modes. Switching to a value based entering mode will allow you to enter the total order value (i.e. how much you are willing to invest), and the system will automatically convert this value into the appropriate number (quantity) of shares.

toggle to switch between quantity and value entering modes. Switching to a value based entering mode will allow you to enter the total order value (i.e. how much you are willing to invest), and the system will automatically convert this value into the appropriate number (quantity) of shares.

- Otherwise, using the default quantity mode allows you to enter how many shares of a symbol you would like to transact (buy or sell).

- For instance, assume one share of a certain stock is 2 AED and you wish to spend a total value of 200 AED on a stock purchase, if the value toggle is active, then you only need to type '200' AED in the value field, and the system will automatically calculate the quantity of shares to purchase (i.e. 200/2 = 100 shares in this case).

- Price – Refers to the market price for a specific symbol. The price field can be customized in all order types except when placing market orders which execute based on the current market price at that moment.

- Portfolio – A portfolio is an entity that contains the cash available for spending within the app (to buy stocks with or proceeds from selling stocks). Further, the stocks that have already been purchased are grouped into Portfolios within the app. Each Portfolio has its own currency based on the stocks it holds.

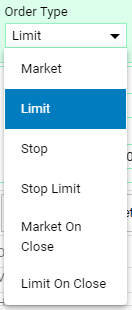

- Order Type – Refers to the type of order that is being placed.

- Market Order – This type of order is sent to the market and is executed at the best bid for sell orders or best ask for buy orders, as available at the time.

- Note that the Price field is not a mandatory field for certain order types such as ‘Market’ orders.

- Limit Order – This is an order where the maximum buying price or the minimum selling price can be specified by the user. Consequently, the order will execute at the specified price (or better).

- Stop Order – This is a market order that is sent to the exchange when the trigger price (the stop price) is reached. When the specified price is reached, your Stop Order becomes a Market Order and is executed at the best available price.

- Stop Limit Order – This is an order that combines the features of a Stop Order and a Limit Order. It is an order to buy a security at no more or sell at no less than a specified Limit Price. Once the Stop Price is reached, the Limit Order is sent to the exchange to buy or to sell at a specified price.

- Market On Close Order – This is a specialized order type submitted to the exchange with the intention of executing a trade at the closing price of the trading day. When the market is about to close, the MOC order is sent to the exchange, and it is executed at the prevailing market closing price.

- Limit On Close Order - This order type specifies a limit price for execution during the closing auction. It only executes if the closing price matches or betters the limit, giving traders price control at the end of the trading day.

- After you've selected the preferred order type, you may then proceed to enter the number of stocks (quantity) and the Price you wish to purchase the stock at.

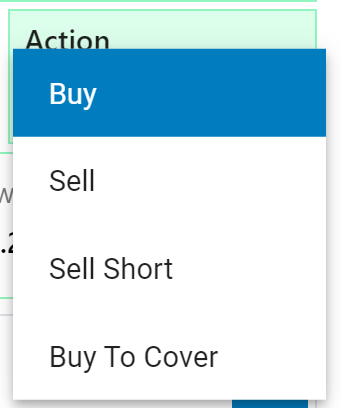

- Action – This field relates to the type of transaction that is needed. I.e. buy, sell, sell short, or buy to cover.

- A buy order is used to purchase/ acquire stocks from the market.

- A sell order is used to sell existing stocks to the market.

- A sell short order is an advanced trading strategy performed by experienced investors as it comes with some risk.

- In a 'short sell' strategy a trader expects a stock's price to decline, as such they "sell" a stock (by borrowing it from a broker) and then buy it back when the price goes back down.

- As the trader is "selling" a stock they do not actually own, it needs to be borrowed from a broker, which incurs an interest charge.

- Thus, when the seller buys the stock back in a separate transaction (see buy to cover section below), they have to ensure that the difference in price will cover both the interest amount as well as their profit amount.

- A buy to cover order is a type of buy order that will close a trader's 'short position'.

- The shares that were borrowed from the broker during the short sale transaction need to be paid back with interest. A buy to cover order provides the mechanism of doing so.

- Thus, in a buy to cover order, the trader would buy an equal number of shares as the ones they borrowed/ shorted (this time at a lower price than before) to cover the value of the stocks borrowed and keep the remaining amount as profits from the short transaction.

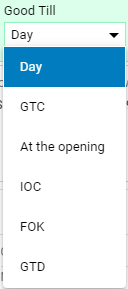

- Good Till – This option lets you select an expiration date and time up until which an order will continue to execute in the exchange.

- GTC – Good Till Cancel (Open orders) are the orders that are active till it gets canceled by the trader. GTC orders are rejected at end of the day if they fall beyond the daily price fluctuation limits.

- AOP – At the Opening order is an order that is bought at a limited price on the initial transaction of the day. If the order or any portion of it is not executed in this manner, it is to be treated as canceled.

- IOC – Immediate Or Cancel is a Market Order or a Limit Order which is automatically canceled unless executed in whole or in part immediately after its receipt.

- FOK – Fill-Or-Kill order is an options order that cancels if it is not filled entirely upon execution. This is specially used for large orders and requires immediate execution.

- GTX – Good Till Crossing or Good Till Executed are the bought orders that are canceled prior to the market entering into an auction or a crossing phase.

- GTD – Good Till Date orders can remain active until a trader specified date.

- ATC - At the Closing order is a type of order executed at a specific price during the closing auction phase at the end of trading day. If the order or any part of it cannot be executed at this designated price during the closing auction, it is treated as canceled.

- Week – These orders expire after a week from the transaction date.

- Month – Month orders will expire after a month from the transaction date.

- Day - Day orders will expire after a day from the transaction date.

- All or None – Ticking this option in the order ticket will tell the system to either execute the full order or none of it.

- Day Order – Ticking this option in the order ticket will tell the system to execute the order within the trading day or cancel it.

- Fractions (i.e. Fractional Trading) – Fractional Trading allows traders to purchase a stock symbol with a quantity less than one full share. Simply put, it is a section of a full share. This is useful when dealing with symbols where the stock price is high, and the buyer wishes to purchase a small fraction of one complete share. Fractional shares could also originate due to M&A activity or due to stock splits.

- Please note the following fields are applicable only to the customized version of the application for the Egypt segment.

- Note: In the case of a Sell order, the order ticket allows the trader to select from the following options.

- Sell T+0: Transaction date (T) + 0 Days

- Sell T+1: Transaction date (T) + 1 Day

- There is a difference that should be noted by the trader between the transaction date and the settlement date of a Sell order. The transaction date simply refers to the date & time on which the Sell order was submitted to the exchange. However, the settlement date refers to the date on which the funds are transferred to the trader's account (which may or may not be on the same day depending on the exchange).

- Book Keeper: This refers to the financial institution which handles the records related to daily transactions and reconciliations.

- Descriptive fields

- Bid Price – This refers to the highest price a buyer is willing to pay for a stock in the market at a given point in time.

- Ask Price – This refers to the lowest price at which a seller is willing to sell their stock in the market at a given point in time.

- Bid-Ask Spread – This refers to the difference between the highest price a buyer is willing to pay for a stock and the lowest price that a seller would accept for a stock. It is the value by which the asking price for the symbol exceeds the bid price for the symbol in the market.

- Qty. in-Hand – The total number of stocks of the selected symbol, that the user currently has in their portfolio (i.e. already purchased).

- Currency – A Currency refers to the basis for trade (i.e. the legal tender of a particular country or region). Within this application, all price data for stock symbols are represented in their applicable monetary currencies (i.e. USD, AED, EUR, etc.).

- Order Value – The value resulting from the multiplication of the Order Quantity and the Order Price.

- Holding – This displays the number of shares the user has already purchased from the symbol.

- Commission – This is calculated by the system as per the commissions defined for the exchange.

- Net Value – This is the total Order Value including the Commission.

- Buy Pending and Sell Pending – This reflects any pending buy and sell orders you have placed for the symbol.

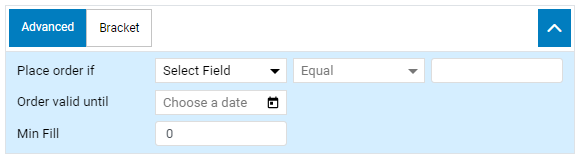

- Place Order If (i.e. Conditional Orders) – These fields allow the user to specify conditional statements when placing an order (i.e. 'Place an order if a particular field (i.e. price), matches a condition (equals, 'less than', 'greater than', etc.) to a certain value then execute the order).

- Order Valid Until – Setting a calendar date through this field will in effect trigger a maximum validity date for the order, if the date has elapsed and the order is still unfilled then it will be canceled.

- Min Fill – Enter an amount here so that the order will only begin to trade if it has the required minimum number of shares (Min Fill) that you entered.

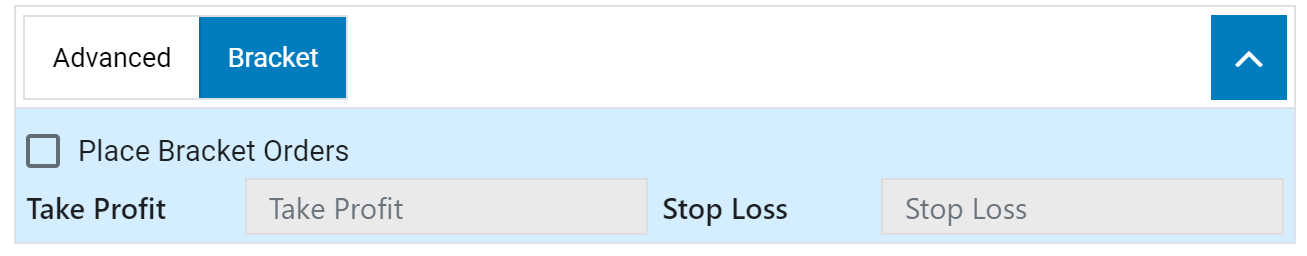

- Bracket orders allow you to define a Take Profit and Stop-Loss prior to placing the order. This tells the system that the order should not be executed unless these defined conditions are met.

- Stop Loss – Shows the calculated amount of the Stop Loss margin (applicable for bracket orders).

- Take Profit – Shows the calculated amount of the Take Profit margin (applicable for bracket orders).

- Select the 'Bracket' tab on the Order Ticket (adjacent to the 'Advanced' tab), then tick the 'Place Bracket Orders' checkbox.

- To place a bracket order, simply specify a take profit and/or a stop loss percentage in the relevant text fields contained in the order ticket (Note: these appear when the 'Place Bracket Orders' checkbox is ticked).

- Then press the relevant action button (i.e. buy/sell) as with a normal order.

- Note: To customize settings relating to bracket orders, please refer to the section on Trade Settings.